David Gardner is the Co-Founder and “Chief Rule Breaker” of The Motley Fool.

David and his brother Tom Gardner founded The Motley Fool in 1993 as a traditional print newsletter based out of Alexandria, VA. The service quickly gained notoriety for David and Tom's successful stock picks and before they knew it the mailing list began to grow.

Fast forward more than 25 years and The Motley Fool is now a sprawling organization with 500,000+ subscribers and more than 500 total employees.

While the Motley Fool has been a success in its own right, David Gardner's personal investment track record, and the surprisingly simple approach that fostered them, will be the focus of this article.

David Gardner's Investment Strategy

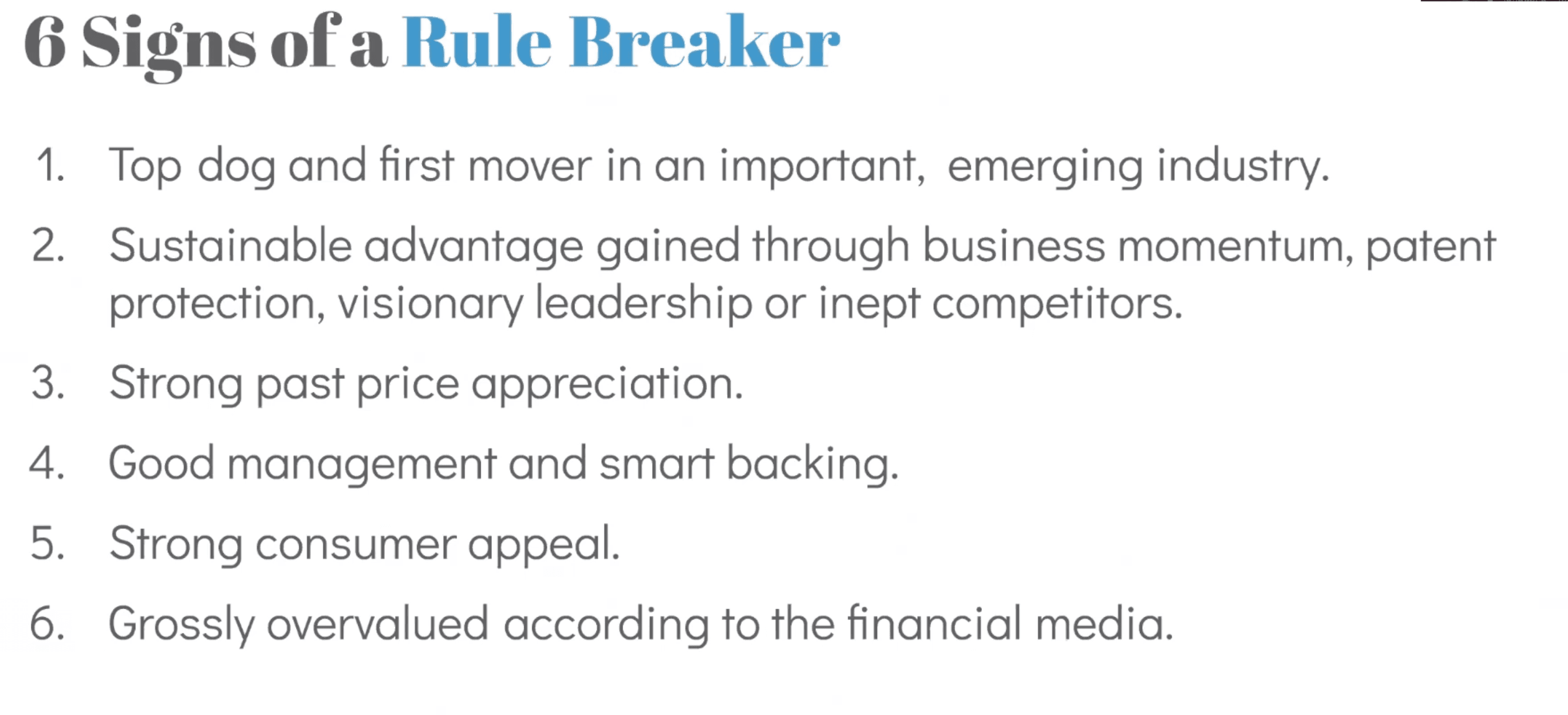

David Gardner seeks out companies that he calls “Rule Breakers”.

These are companies that break the rules of the business status quo by bringing “disruptive technology, diabolically clever marketing, or a totally new business model into the world.”

Here are Gardner’s 6 criteria for finding “Rule Breakers”:

Favorite Holding Period: Forever

Although this recipe for finding stocks might seem simple, the magic comes from David's unique approach to portfolio management.

Legendary investor Charlie Munger once quipped: “The big money is not in the buying and selling, but in the waiting.”

And few investors exemplify that as well as David Gardner.

For most investors, it's easy to feel compelled to take a little profits off the table, or even sell out entirely, once a stock has doubled or tripled. But Gardner takes a different approach.

David Gardner's first rule for portfolio management is to "Let Your Winners Run... HIGH."

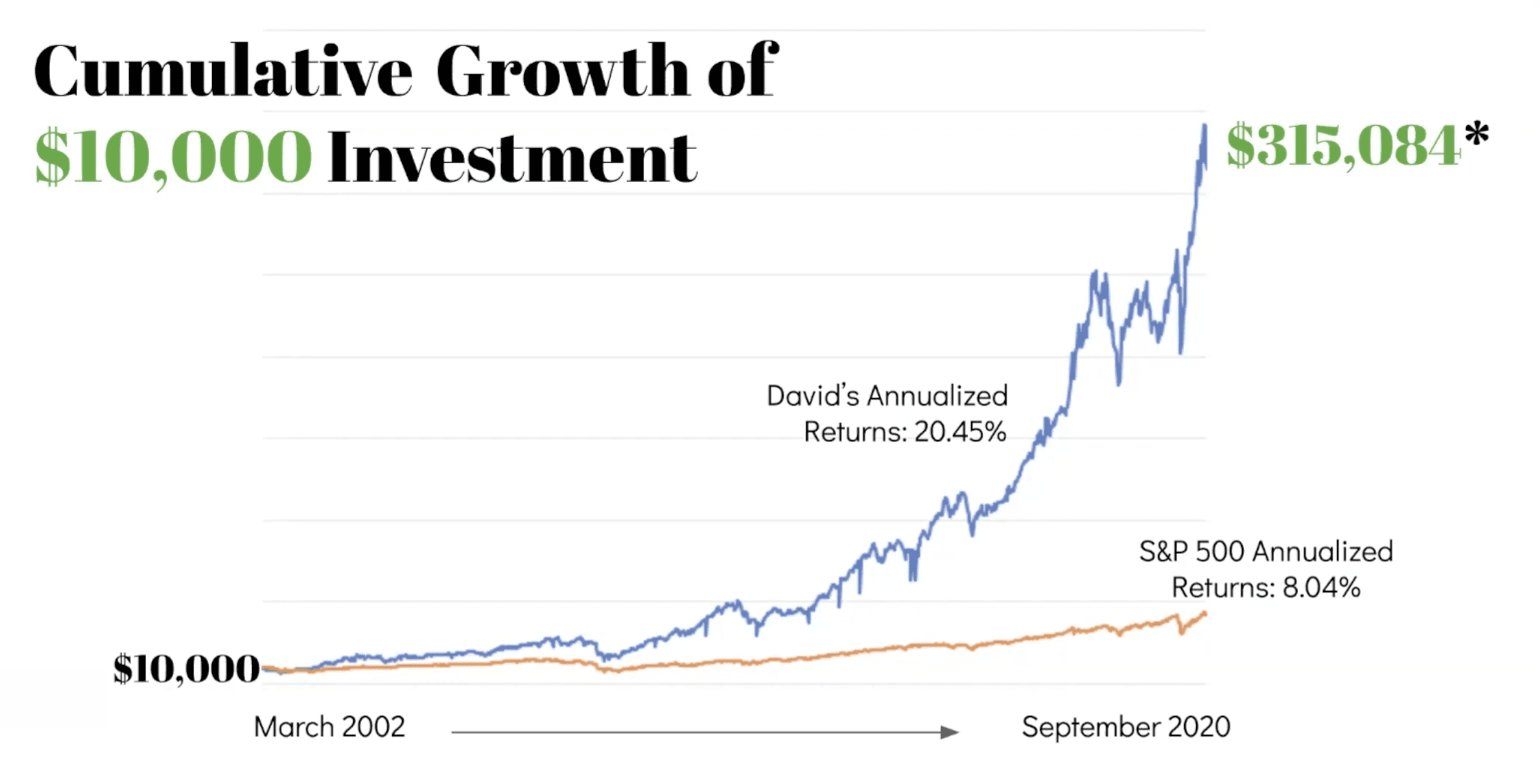

This "Buy Right and Sit Tight" strategy has allowed Gardner to find and hold some of the world's greatest companies over the last two decades, even through major drawdowns as well as extended periods of "overvaluation".

All in all, holding these long term winners has helped Gardner to generate more than 20% annualized returns since 2002.

Gardner's Biggest Winners

To get a better understanding of just how Gardner generated these market-beating returns over the last 20+ years, let's take a look at some of his all-time best performers.

1.) Amazon

Initial Purchase: 1997 for $0.16 per share (split-adjusted).

Current Price: $226.56

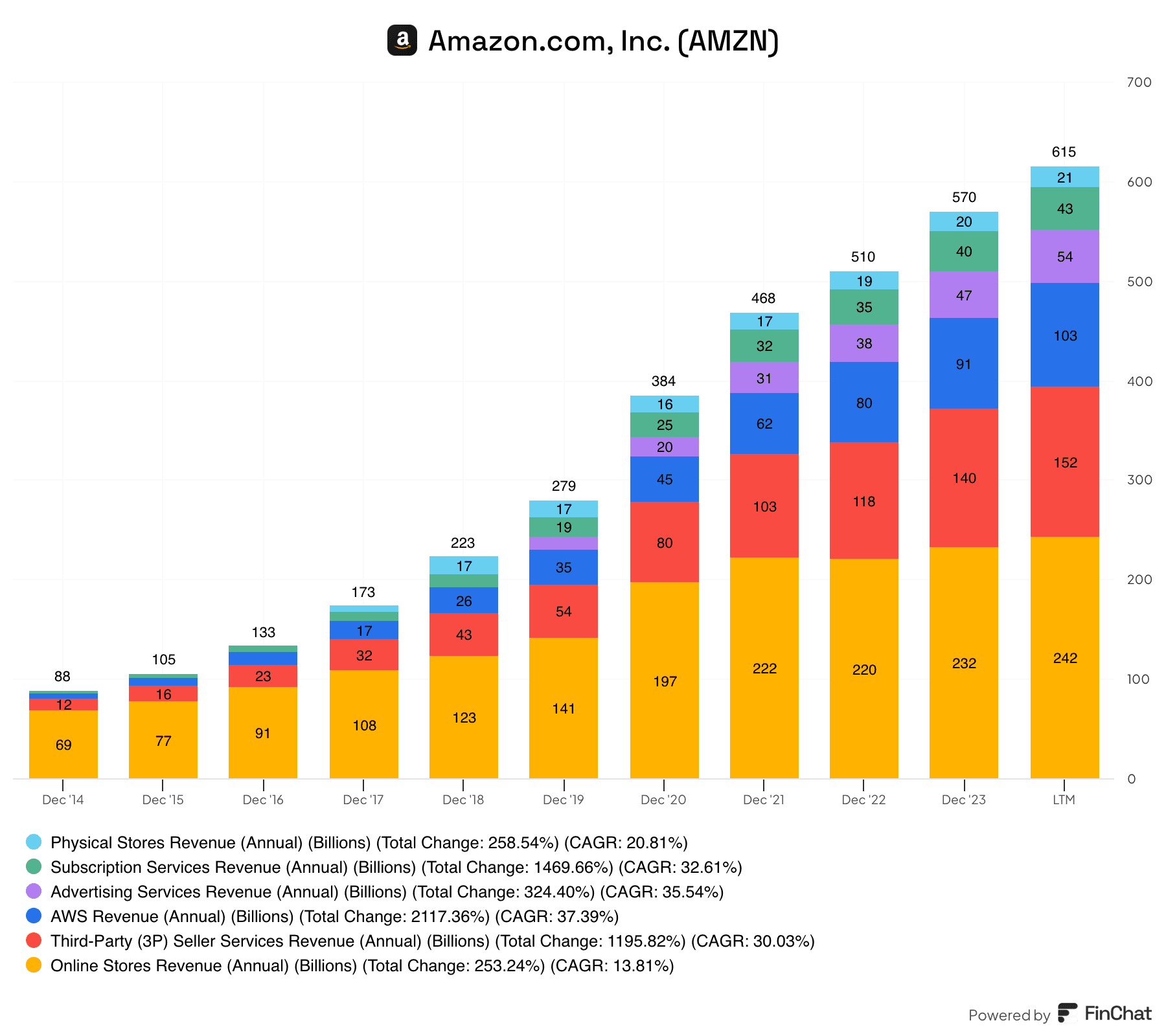

When Gardner first purchased Amazon, the company wasn’t much more than an online book seller. But Gardner believed that Amazon had a major advantage over peers, and that advantage was Jeff Bezos. 27 years later and Amazon is now the global leader in e-commerce, cloud computing, and much more.

Gardner's 4th sign of a Rule Breaker (Good Management and Smart Backing) was particularly influential here. Great management teams are often able to expand their addressable market and Amazon is a perfect example of that. The chart below shows how Amazon was able to add new incremental revenue streams over the years as it compounded its past successes.

Amazon today is more than a 1,400 bagger since Gardner’s initial purchase.

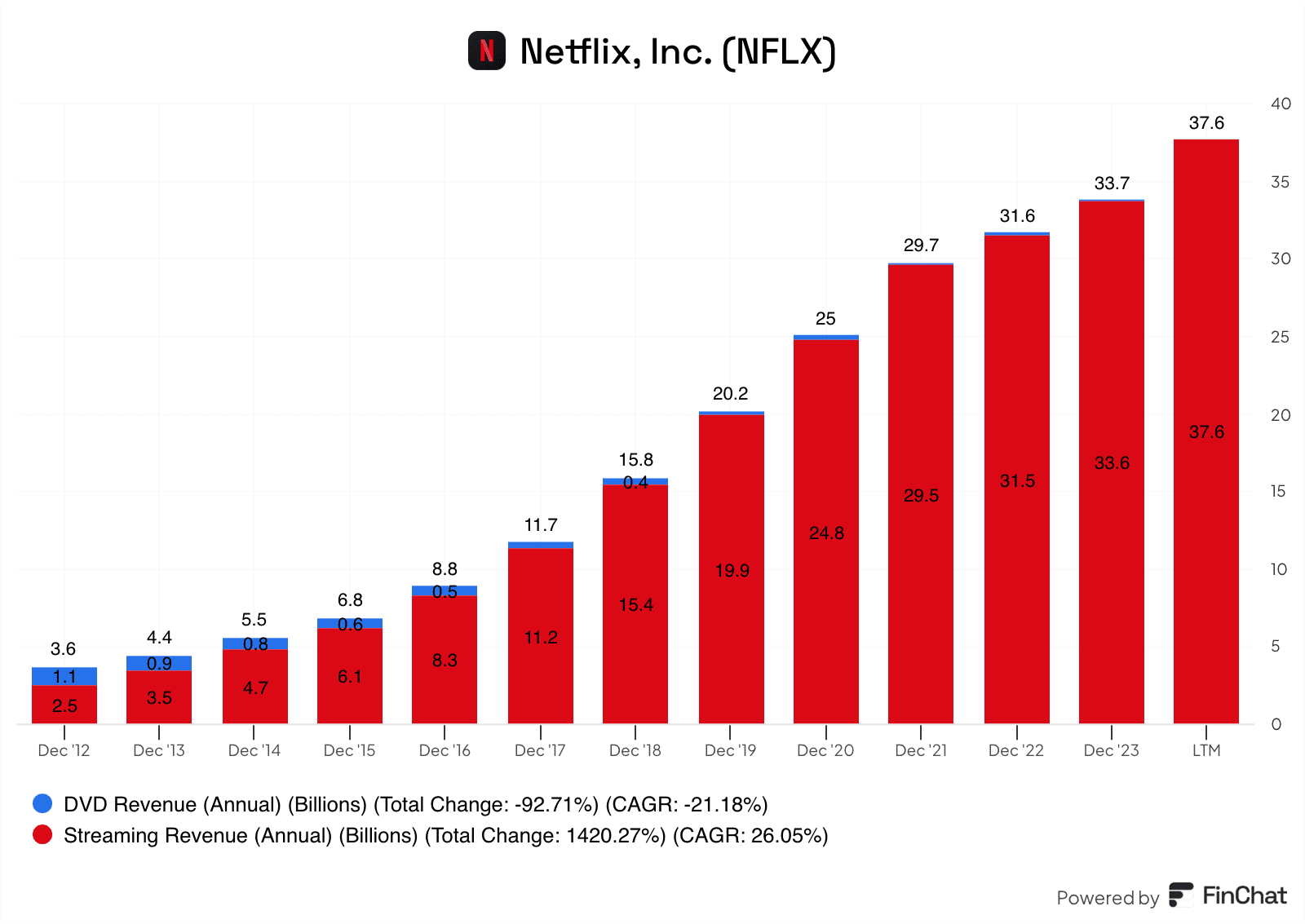

2. Netflix

Initial Purchase: 2004 for $1.85 per share (split-adjusted).

Current Price: $912.53

When Gardner first bought Netflix, the company was in the online DVD distribution business. At the time, optimistic investors believed that one day they could potentially disrupt Blockbuster. But no one thought they could disrupt the entire linear TV category.

Fast forward 20 years and Netflix is the clear leader in the streaming TV market. This has helped turn Gardner’s original investment into a 492-fold return.

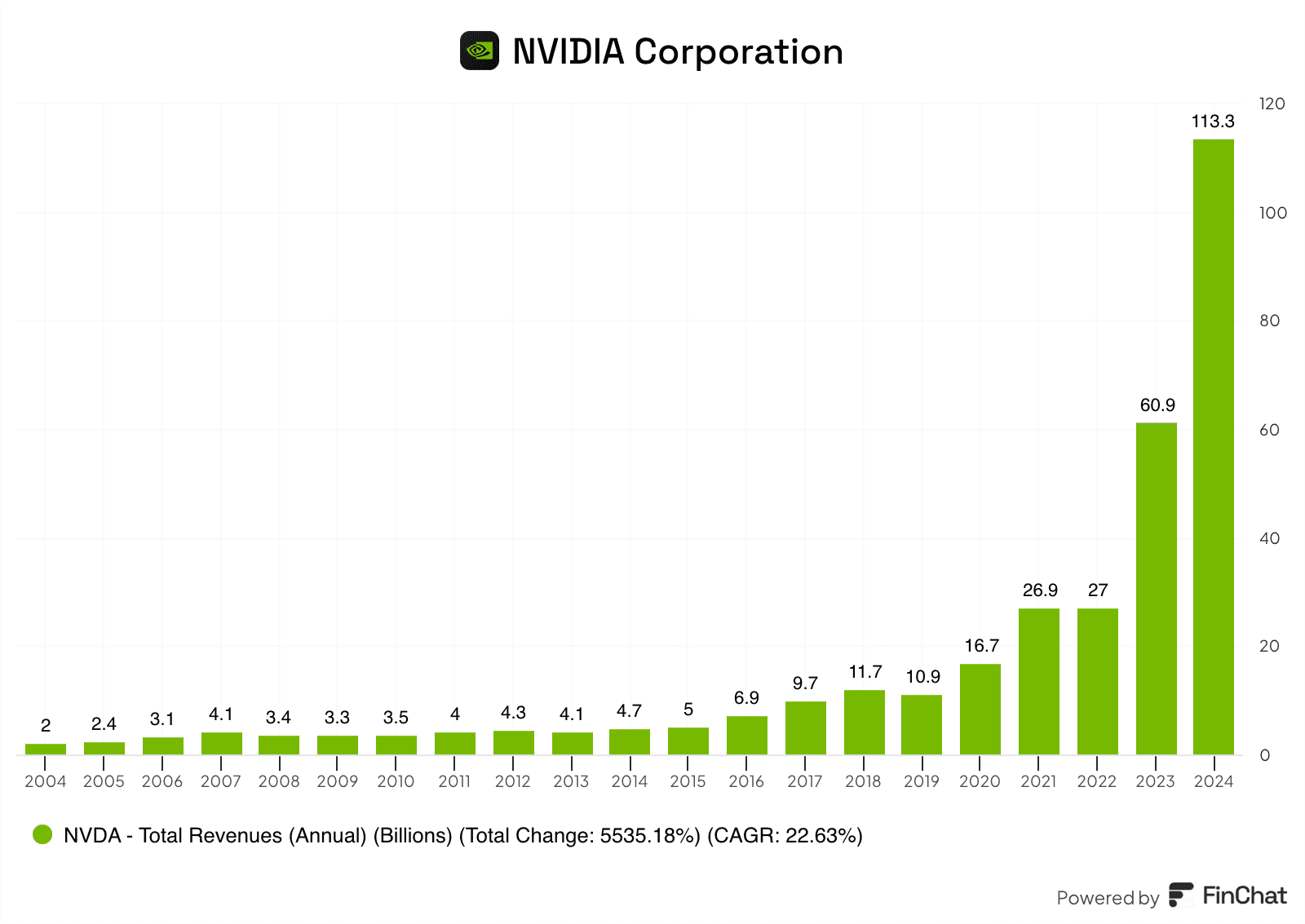

3. NVIDIA

Initial Purchase: 2005 for $0.164 per share (split-adjusted).

Current Price: $132.7

Most people today automatically think of NVIDIA as a wonderful investment. However, for the first 10 years that Gardner owned the stock it was quite a laggard. From 2006 to 2015 the stock went virtually nowhere. How many people would have held through that period?

Fast forward to today and revenue is up 2,319% from 2015 and Gardner’s investment has turned into an 808-bagger in less than 20 years.

4. MercadoLibre

Initial Purchase: 2009 for $14.13 per share.

Current Price: $1,825.08

MercadoLibre has been replicating the Amazon e-commerce playbook in South America for now more than 20 years. While many investors doubted MercadoLibre due to the logistical challenges of delivering packages in certain Latin American markets, Gardner let them prove it.

Low and behold, the model worked. As it turns out, customers in Latin America want the same efficiency and convenience of ordering online as American customers. MercadoLibre today is a 128-bagger since Gardner’s initial purchase.

Although we highlighted some of Gardner's biggest winners, he's had his fair share of losers as well which Gardner has mentioned throughout his books. Companies like American Online, TCBY, Media Logic, and many more looked like Rule Breakers at first, but for one reason or another, never panned out.

Fortunately for Gardner (and all investors) winners and losers don't count the same in investing. The upside of holding just a few major winners over 2 to 3 decades can more than account for the losers, and in Gardner's case, that's exactly what has happened.

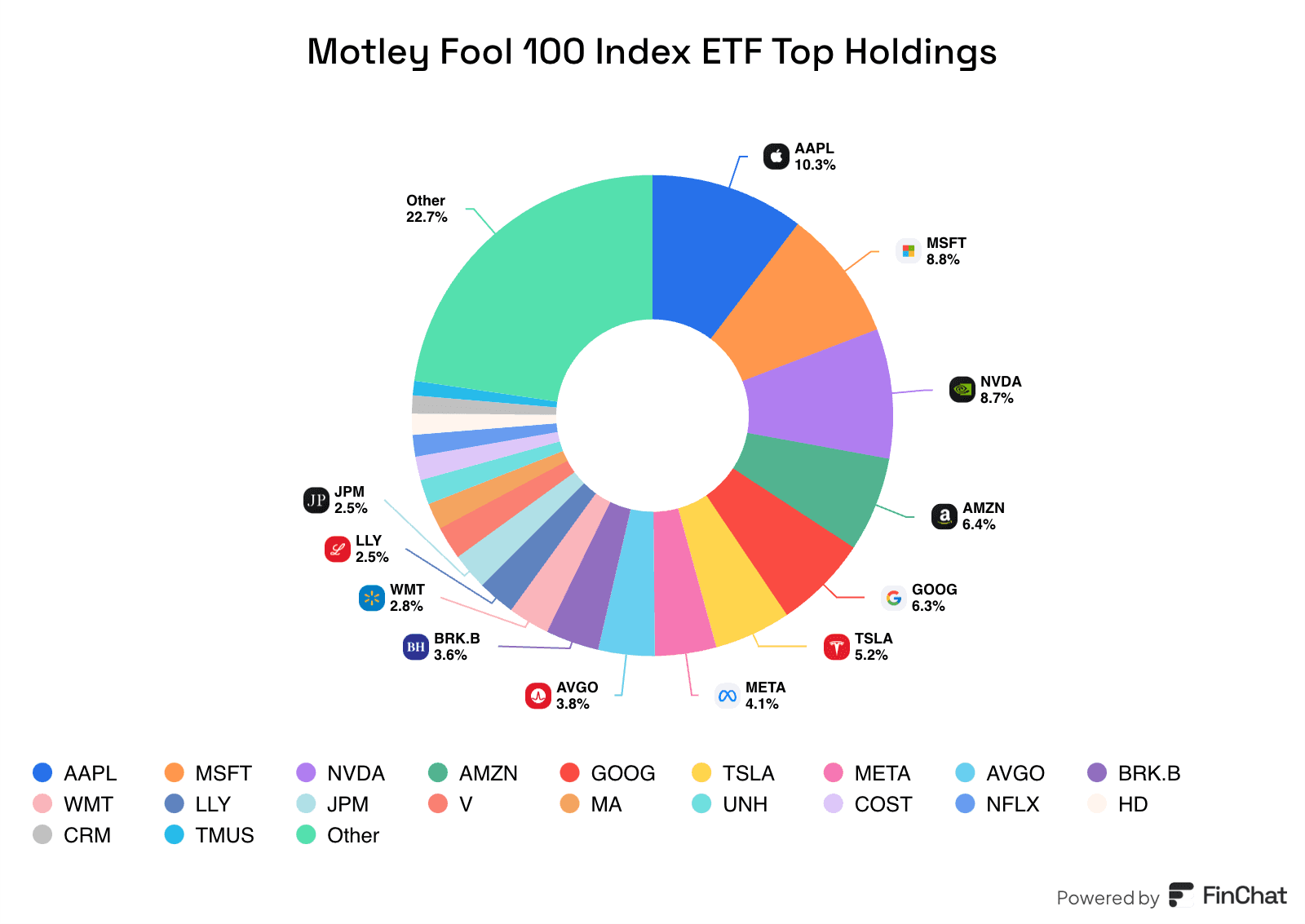

While Gardner's personal holdings aren't publicly available, his investment style and influence still permeates throughout the Motley Fool organization.

Here's a quick look at the Motley Fool 100 ETF top holdings: