It's no secret that the largest tech companies in the world are impressive businesses. They have best-in-class products, unparalleled distribution, and virtually unlimited resources.

But thinking of them as individual businesses isn't really accurate. Between Apple, Microsoft, Amazon, Meta, and Alphabet, there are actually more than 100 subsidiaries driving the remarkable results investors see each quarter.

Here are the most important ones:

Microsoft

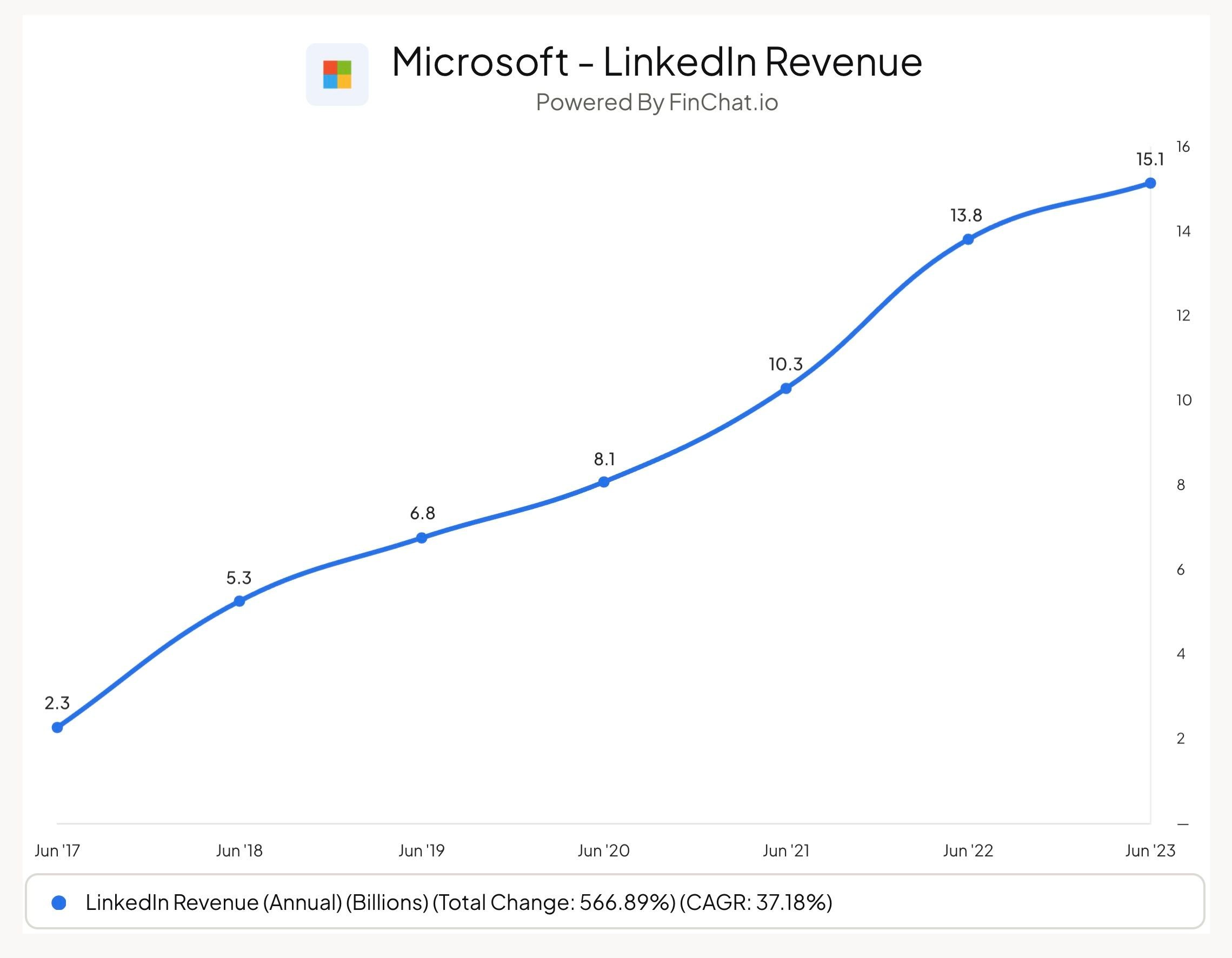

LinkedIn: Microsoft acquired LinkedIn for $26 billion in 2016. Today, as the largest social network for professionals, LinkedIn is home to more than 1 billion members and generates $15 billion in revenue annually. And they generate revenue in several ways.

Talent solutions (businesses pay to find potential employees)

Marketing solutions (traditional ads & business-to-business marketing tools)

Premium subscriptions (extra platform perks for business leaders & job seekers)

Sales solutions (paying for leads)

With a powerful network effect, the cost to attract new users continues to come down over time. This means LinkedIn is likely quite profitable for Microsoft.

Microsoft Office: The one-stop-shop for workplace productivity tools. This encompasses Word, Excel, Powerpoint, Teams (Slack Competitor), Outlook, OneDrive, and more. A personal plan costs $70 per year.

Once Microsoft Office is engrained in a business's workflows, it becomes increasingly difficult to replace. More and more spreadsheets, slideshows, and presentations are shared within the organization and transitioning to anything else would be far too time consuming.

This stickiness has given Microsoft the ability to raise the price of its bundle over the years, while the cost to deliver the service has come down thanks to the shift towards digital distribution.

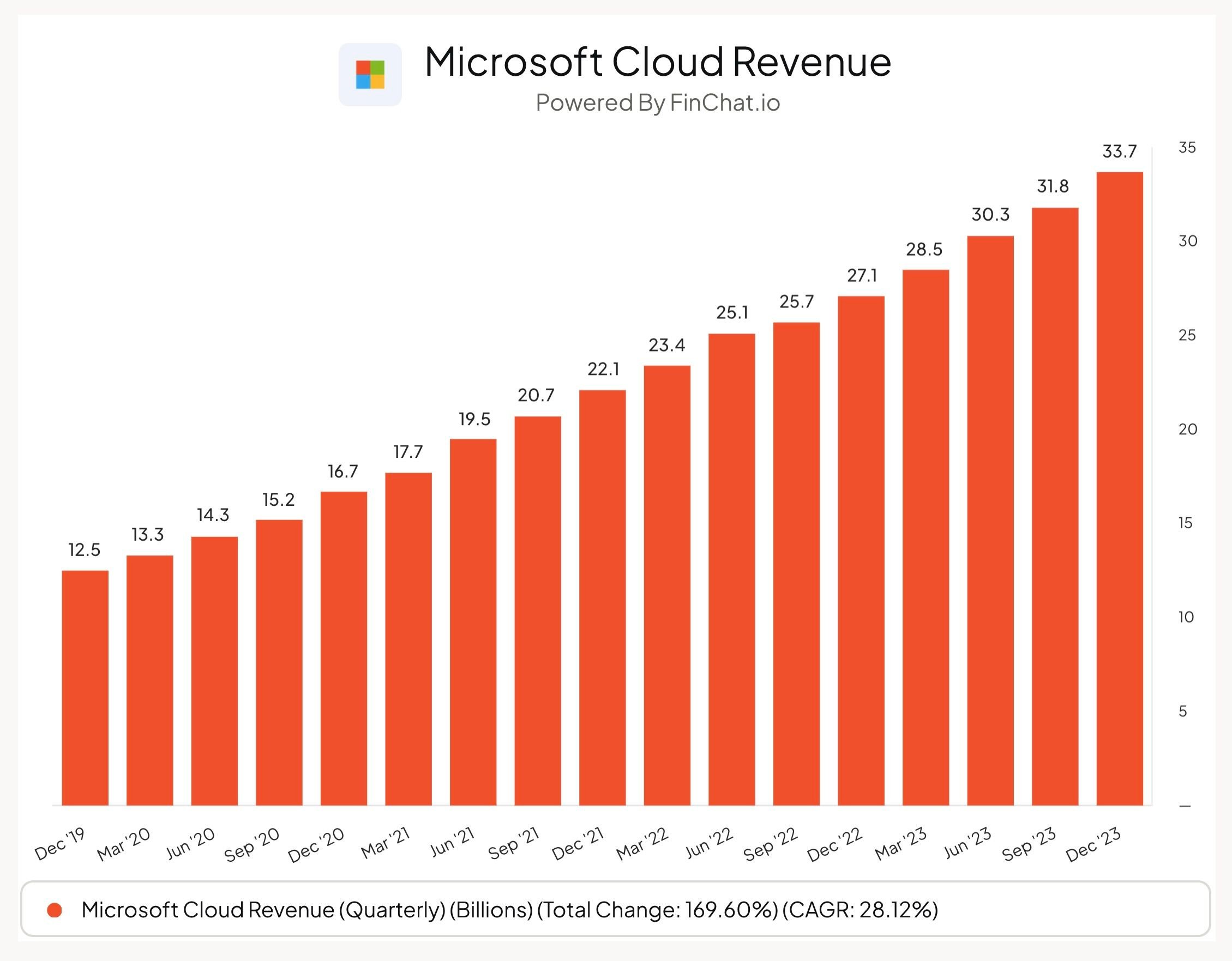

Azure: “You should just think of it as the oxygen that the company runs on… it is the backbone of the entire Microsoft.” - Microsoft Chief Marketing Officer, Takeshi Numoto

Azure is Microsoft’s own public cloud computing business and the 2nd largest cloud operator in the world. Like other public cloud providers, Azure enables companies to optimize their costs with elastic computing. Though not specifically broken out, Microsoft’s "Cloud Revenue" overall has amounted to $124 billion in revenue over the last 12 months, up more than 100% from 3 years prior.

While the shift to the cloud may still be in the early innings, there are already clear advantages showing up for the scaled players like Azure. Perhaps the most obvious one is the vendor lock-in. Once a company has migrated workloads to a certain cloud provider it’s often both difficult and impractical to switch providers. It’s expensive, time-consuming, and typically requires downtime for a company’s applications.

GitHub: GitHub is one of the world’s most popular platforms for developers to share code and work on projects together. And it sells subscriptions to teams and organizations.

Microsoft acquired GitHub in 2018 for $7.5 billion in stock. And today, the platform has more than 100 million active users and is used in more than 75% of Fortune 500 companies. Though there isn’t a ton of disclosures around this business specifically, Microsoft has given some details throughout their conference calls.

GitHub currently generates more than $1 billion in annual recurring revenue and as of last quarter, it was growing that figure by more than 40% year-over-year. Similar to LinkedIn, GitHub possesses a major network effect as the value of the platform is improved by each new developer that joins.

Xbox: While often overlooked within the Microsoft complex, Xbox would be one of the largest gaming companies in the world on its own. The entire Xbox ecosystem as a whole (Consoles, 1st Party Games, App Store, GamePass, etc.) generates more than $15 billion per year in revenue. Here's where that revenue comes from:

Xbox GamePass: GamePass is a $10/month subscription that gives members access to hundreds of downloadable games (both 1st and 3rd party), as well as Xbox Live Gold. GamePass is also supported on mobile devices as well as PCs.

App Store: Xbox collects revenue for sales of 3rd party games through its app store. Additionally, 3rd party publishers can pay Xbox to advertise their games within the app store.

Xbox Hardware: The Xbox Series X is the newest generation of Xbox consoles. The console costs $500 at a minimum and contains a disc drive that’s compatible with games for previous generations.

1st-Party Games: Xbox has several of its own studios located all around the globe including Alpha Dog Games, Bethesda Game Studios, and soon, Activision Blizzard’s various development studios. These studios are responsible for the development of many globally loved games including Minecraft, Forza, Halo, Age of Empires, DOOM, Fallout, and if the ATVI deal closes, Call of Duty, World of Warcraft, Candy Crush, and plenty more.

Alphabet

Google Search: The starting point for most people on the internet. Google search generates revenue by allowing companies to bid on keywords. This is some of the most valuable (and profitable) ad inventory in the world and is why Google Search is referred to as “A toll-road on the world’s information.”

Among all search providers worldwide, Google commands a whopping 91.5% market share across all devices and more than 95% specifically on mobile.

Over the last 12 months, Google's "Search and Other" segment delivered $175 billion in revenue, up 8% from the year prior.

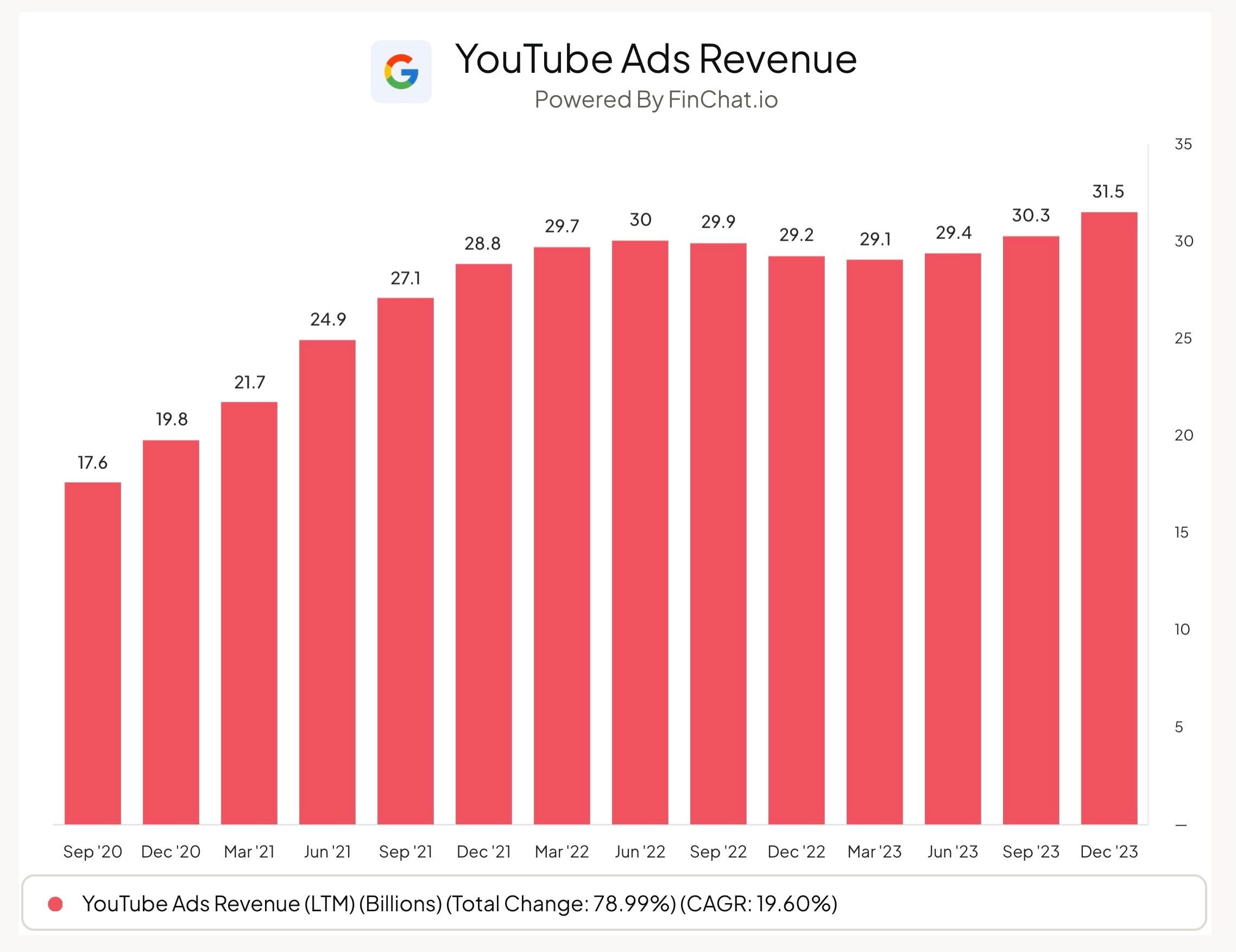

YouTube: YouTube is the largest video sharing platform globally. To provide some context on the insane scope of this business, YouTube has more than 2 billion monthly active users, the average user spends about 30 minutes to 1 hour on the platform every day, and behind Google itself, Youtube actually has the second highest amount of search queries of all other platforms.

But beyond its core advertising business, YouTube also generates subscription revenue through YouTube Premium and YouTube TV. As of the latest update, YouTube had more than 80 million subscribers in total.

Google Workspace: Workspace is Google’s complete collection of business collaboration tools. This includes Gmail, Google Drive (Docs, Sheets, Slides), Calendar, Google Meets, Chat, etc. Every individual gets 15 GBs free but if you want to upgrade your storage or create a custom email, you can subscribe to a range of business plans.

While workspace isn’t massively valuable in terms of direct revenue, it’s helpful for keeping customers locked into the Google ecosystem. Workspace has more than 3 billion users globally and Gmail specifically is home to more than 1.8 billion daily active users. This added value for customers further cements Google as the home page for most internet users.

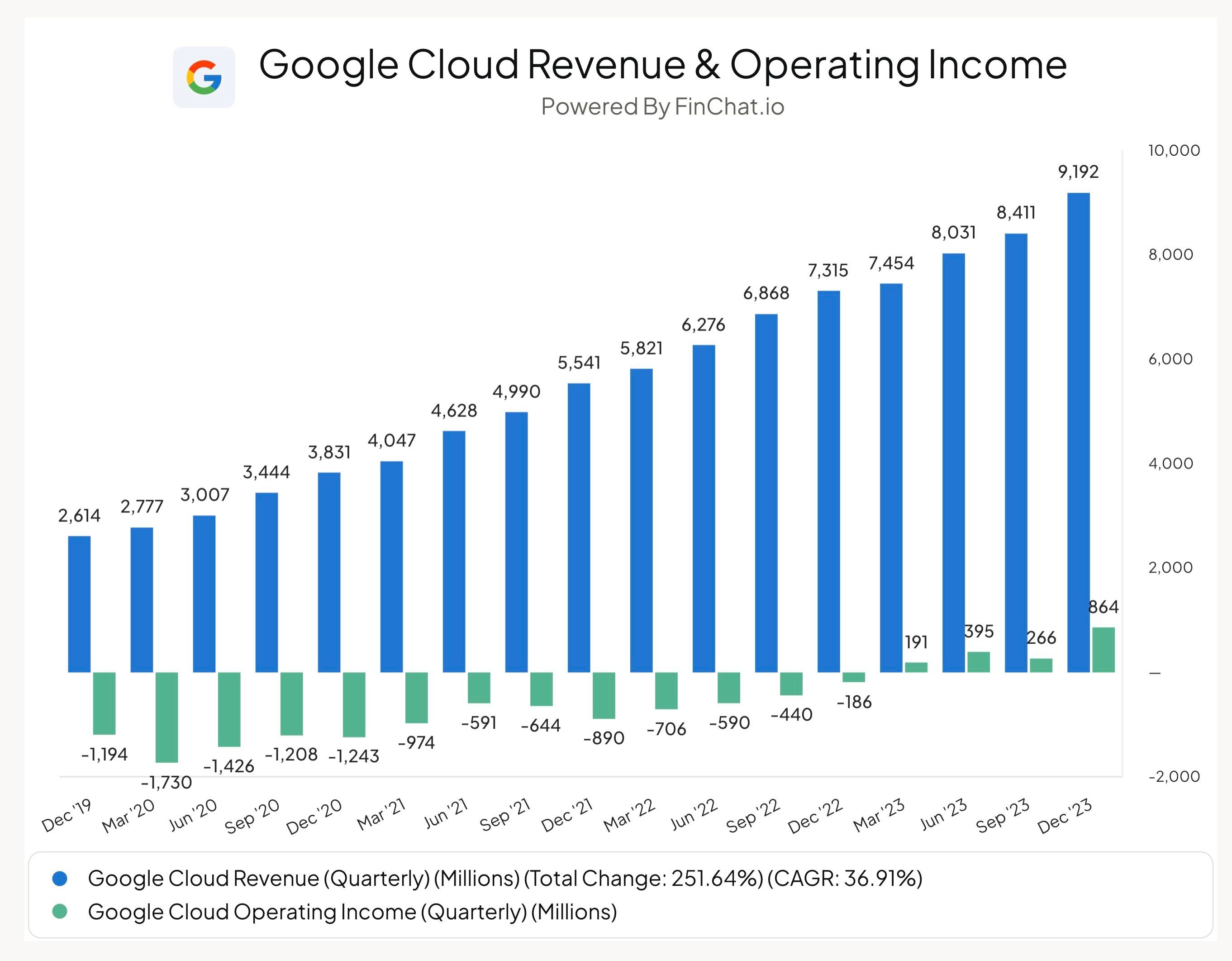

GCP: Google Cloud Platform (GCP) offers companies a variety of cloud services including computing, data storage, data analytics, and machine learning. Beyond offering its solutions to other enterprise customers, GCP also powers Alphabet’s own internet services like Search, YouTube, and its AI tools.

GCP is the 3rd largest cloud computing business in the world behind AWS and Azure. Over the last 12 months GCP has generated $33 billion in revenue, which is up 470% from 5 years ago. As GCP has scaled, it has gradually improved to positive GAAP profitability.

Android: Google acquired Android in 2005 for just $50 million and today, Android is the leading smartphone operating system globally with ~70% market share.

While this isn’t a huge revenue generator for Alphabet, it has been instrumental in helping the company shift to a mobile-first world. The way this business works is that Google makes Android available for free (most of the time) for hardware providers to use it as their operating system. All they have to do in return is pre-install Google’s core applications like Chrome, YouTube, Google Play, and Maps.

This enables manufacturers to sell phones for cheap around the world, while giving more and more people access to Google’s other high margin services.

Amazon:

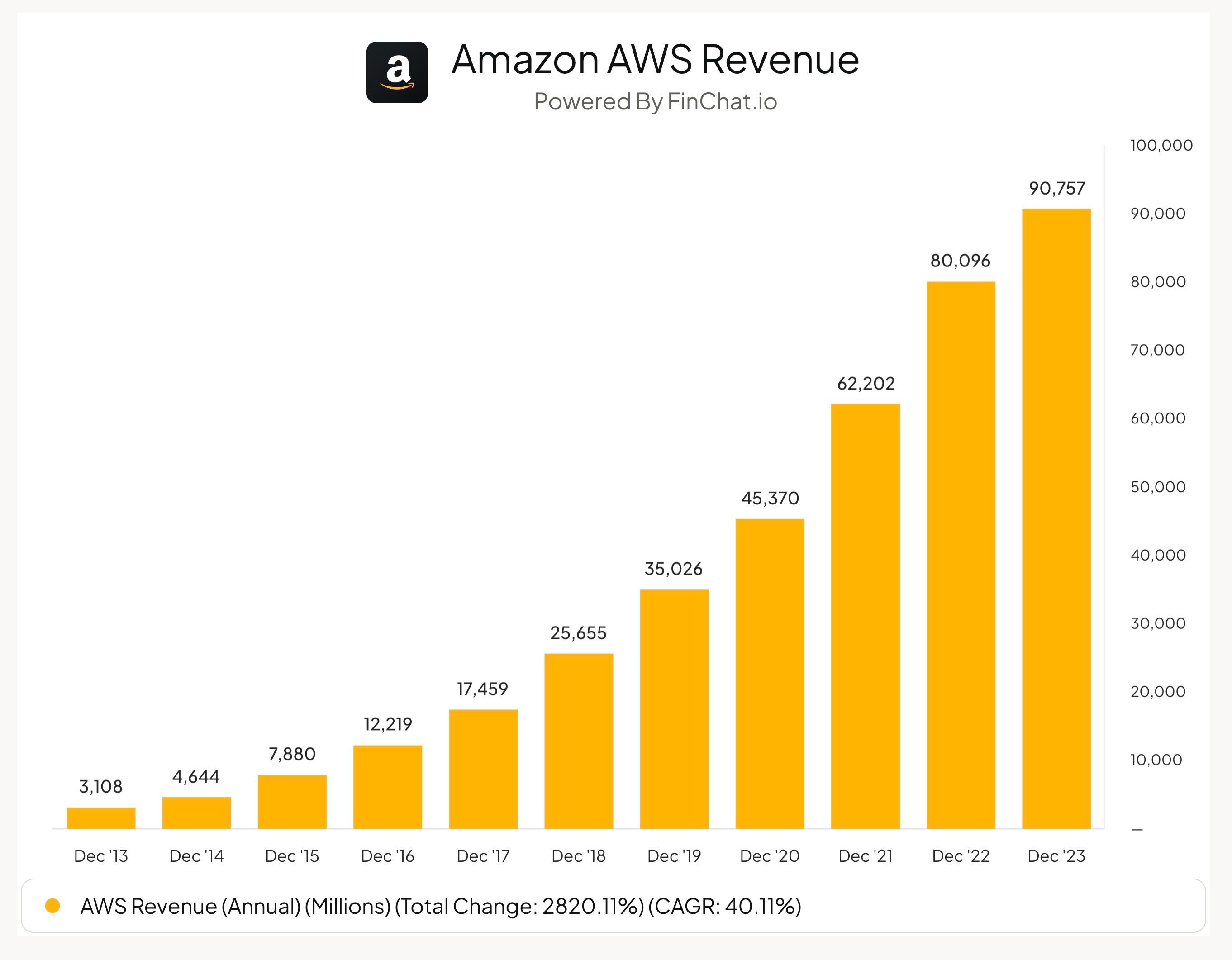

AWS: The pioneer behind elastic computing and the world's most broadly adopted cloud. AWS was initially founded in 2006, and today provides a variety of offerings from compute services to storage and database solutions.

Amazon’s current CEO Andy Jassy led AWS in its early days and still continues to express his optimism about the business during conference calls. During the 2022 Q4 call, Jassy stated “90% to 95% of the global IT spend remains on-premises” and continued “I really do believe in the next 10 to 15 years that most of it will be in the cloud”.

Today, more than 90% of Fortune 500 companies use AWS.

Prime:“Our goal with Amazon Prime … is to make sure that if you are not a Prime member, you are being irresponsible.” - Jeff Bezos.

Prime is Amazon’s way of tying all its sprawling initiatives into one unified customer lock-in. For $139/year in the US, customers get free unlimited shipping, access to prime video, and plenty more.

Amazon Prime has more than 200 million members globally, and Amazon's "Subscription Services" revenue (which is predominantly Prime subscriptions) generated just over $40 billion in revenue for Amazon over the last 12 months.

Amazon Advertising: Amazon generates advertising revenue in a number of ways (on Amazon Podcasts, on Thursday Night Football for Prime Video, across its hardware devices, etc), but by far the most important is through its sponsored listings on Amazon’s e-commerce website.

Amazon lets 3rd party sellers pay for promoted listing slots on its platform. Best of all, the sellers pay on a cost-per-click model so they can better measure the effectiveness of their marketing spend. And since the advertising revenue is primarily self-serve, it’s most likely very high margin for Amazon which helps boost the overall profitability in its retail segment.

Over the last 5 years, Amazon’s Advertising revenue has more than tripled and has generated ~$47 million over the last 12 months.

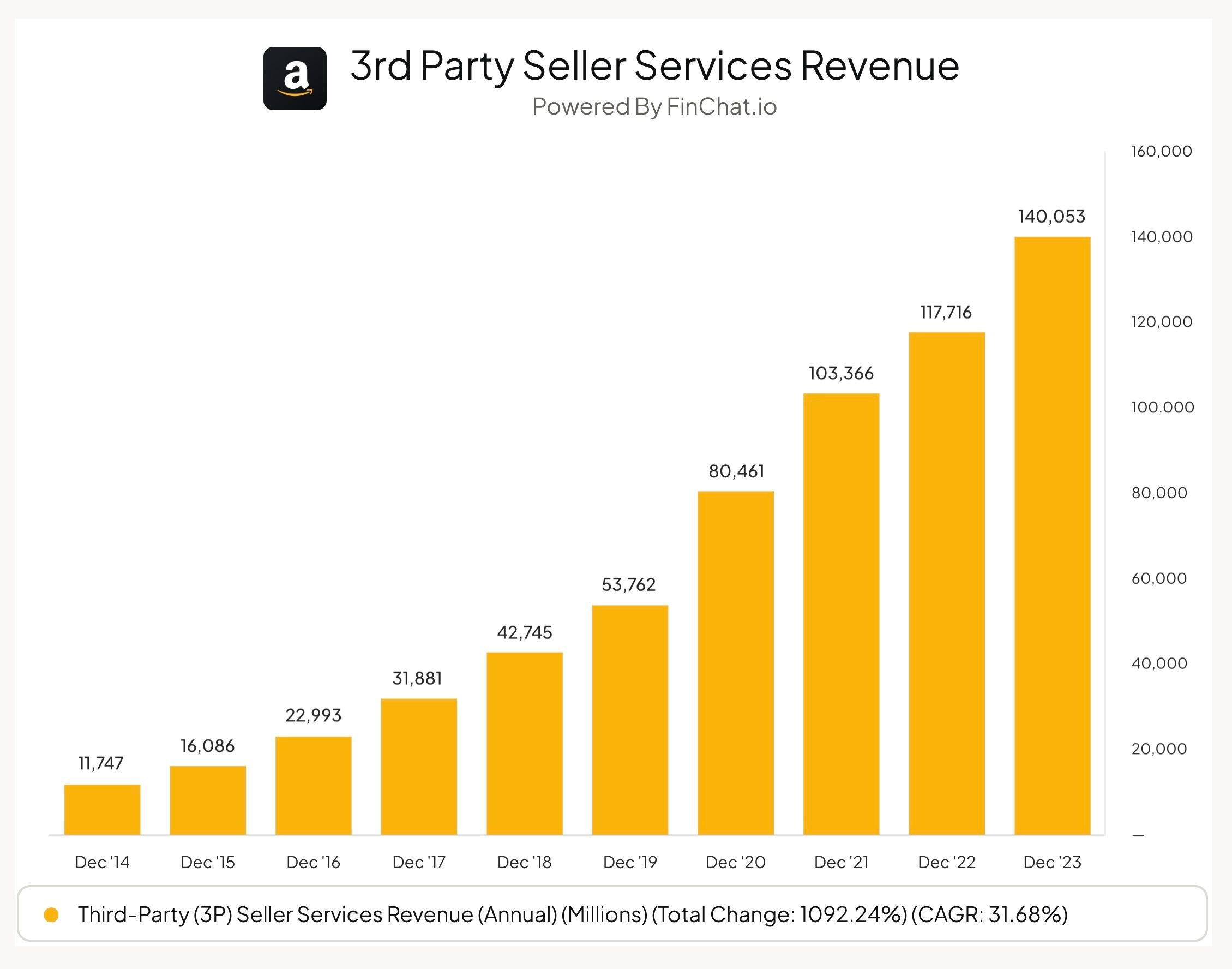

Seller Central: 3rd-Party sellers come to Amazon for pretty much two reasons. They have the best distribution capabilities and there’s a massive audience to sell to. There are actually a ton of different revenue streams from here (storage costs, handling fees, shipping fees, professional plans, etc.), but basically, 3P sellers are offered a number of ways to sell on Amazon which include fees and commissions.

According to a recent interview with CEO Andy Jassy, Amazon actually generates greater profits on 3rd party orders than they do on 1st party orders.

Apple:

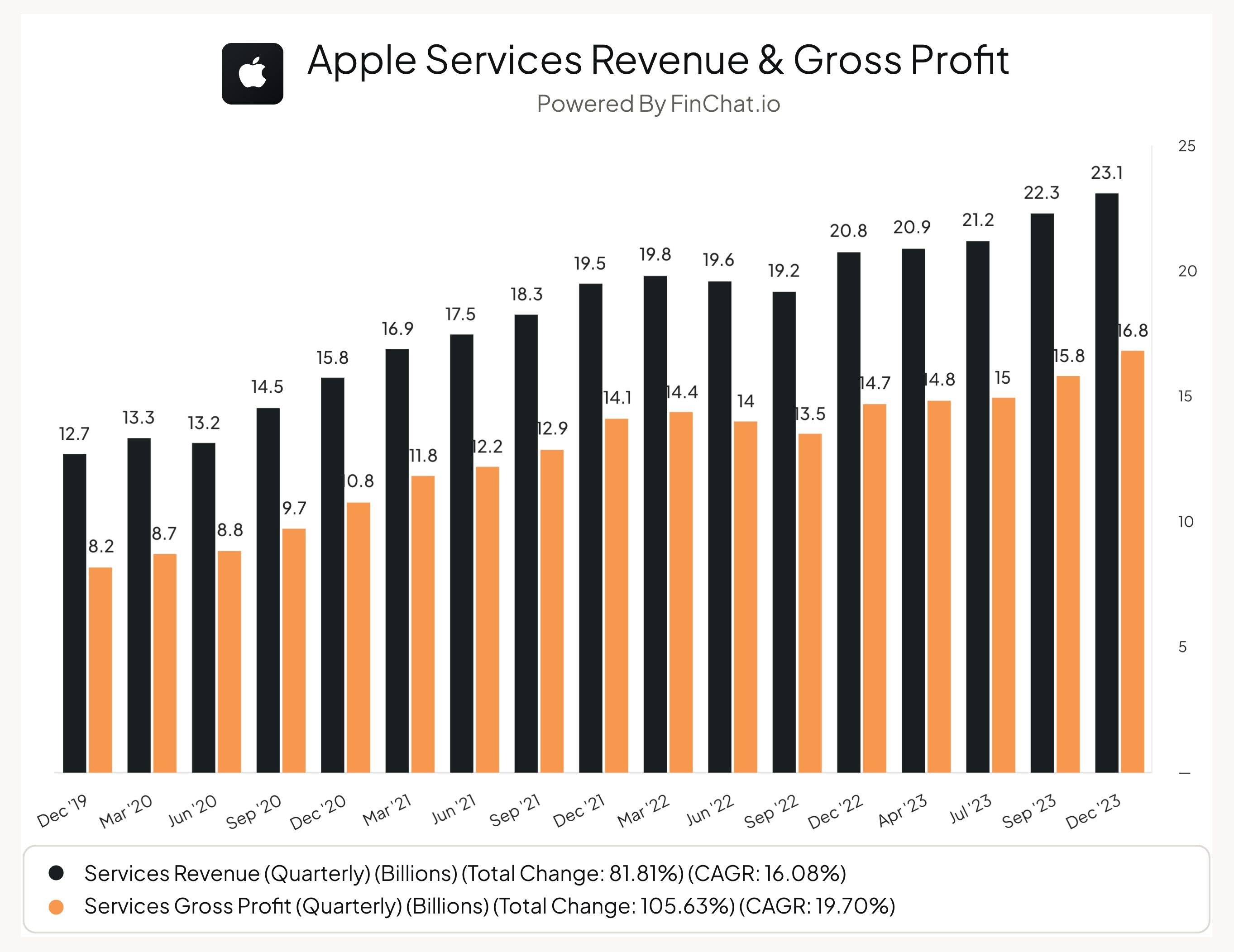

The App Store: Though it’s receiving severe regulatory scrutiny around the world right now, Apple’s App Store is basically a toll booth on the mobile economy.

For all in-app purchases paid for on iOS, Apple takes a 30% cut. And at the moment, Apple prohibits other app stores on iOS, making them practically a monopoly across their own devices.

Safari: Although Safari might not be the first thing that comes to mind when you think of the best business in the world, it’s actually one of the most profitable segments for Apple.

It’s reported that in order to be the default search engine for Safari, Google pays Apple 36% of the advertising revenue it generates from the app. Last year, that figure came out to ~$18 billion. Even though that’s only ~5% of Apple’s overall revenue, it’s virtually pure profit as that revenue requires little to no cost for Apple to generate.

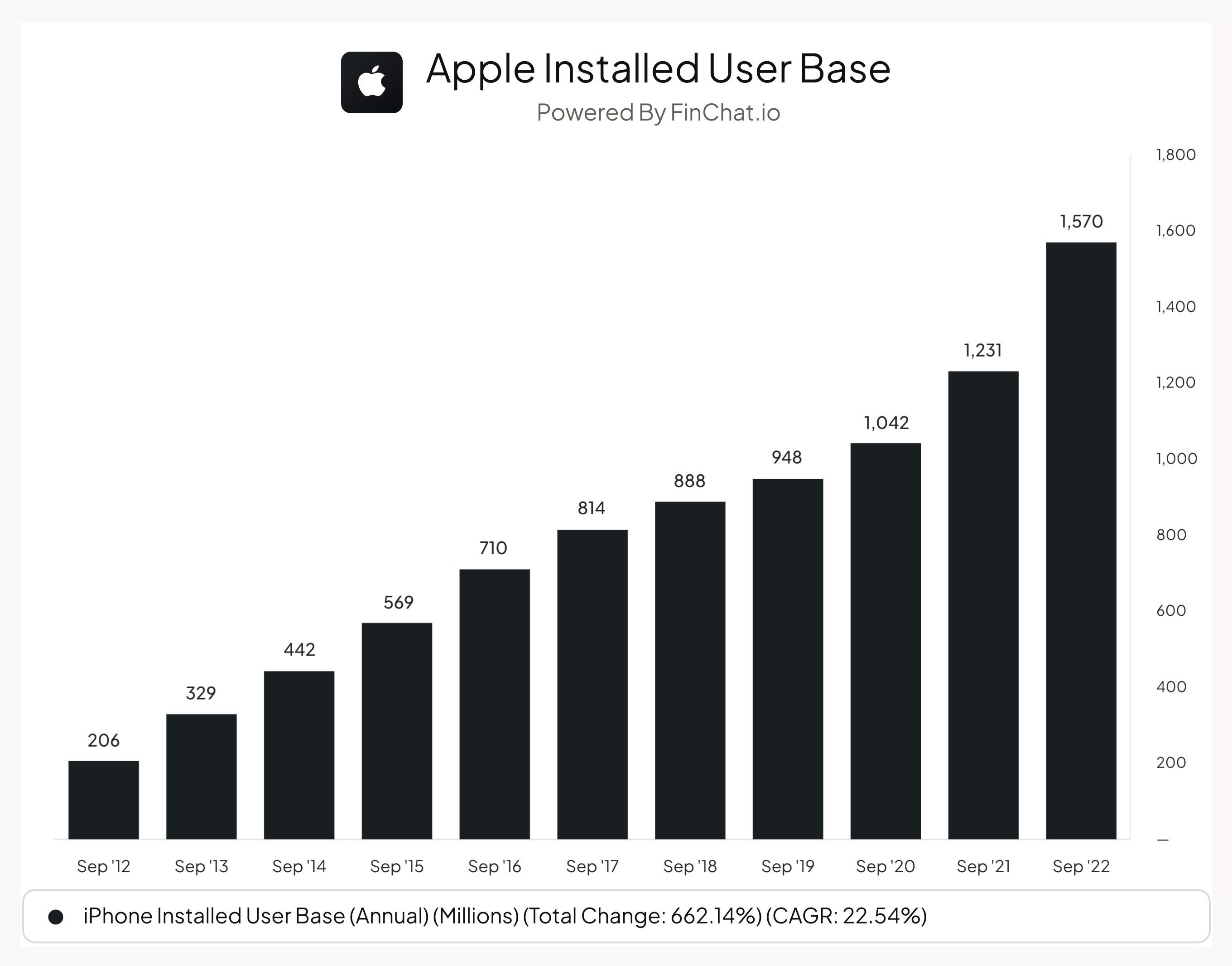

iCloud: iCloud is Apple’s own cloud service that allows iOS users to store and sync data across devices. For a single user to access iCloud, it costs just $0.99/month. While this isn’t a huge revenue driver for Apple in the grand scheme of things, this drastically improves customer lock-in.

Upgrading to a newer iPhone version, is much easier now thanks to data storage in the cloud and tying data across devices encourages customers to buy more iOS enabled devices, which is still the largest profit driver for Apple.

Meta:

Facebook Blue: As the world of social media evolves, it’s easy to overlook the original platform that helped Facebook to become the tech giant that it is today. Facebook Blue is still a behemoth in the social media space with 2 billion people around the globe visiting it every day. And that number is actually growing. Not only is Facebook adding more than 100 million daily active users every year but time spent on the platform continues to grow as well.

Facebook Blue is one of the best places for businesses to advertise and they continue to add new revenue streams as well. Facebook wants to be at the forefront of social commerce and one way they’re doing that is by allowing businesses to set up online shops within the actual Facebook platform.

Instagram: Facebook’s purchase of Instagram in 2012 for $1 billion may go down as one of the best acquisitions of all time. Today, Instagram is estimated to have ~2.4 billion active users and is yet another network effect driven business for Meta.

While Meta doesn’t disclose Instagram’s financials specifically, in a recent court case with the FTC, Meta’s filings showed that Instagram generated $32 billion in revenue in 2021. That was more than YouTube at the time and that figure has likely grown since. Not bad for a $1 billion acquisition.

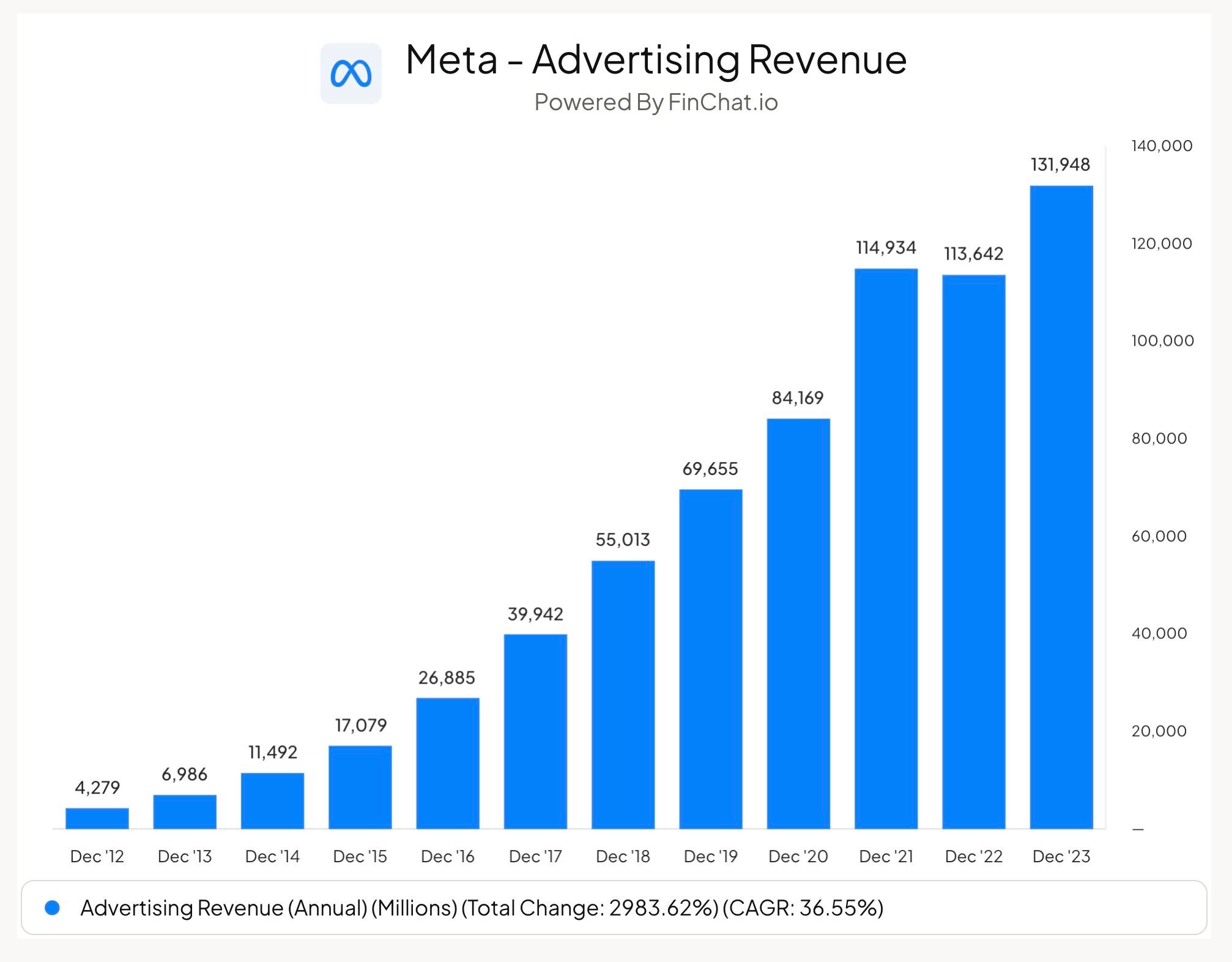

In the world of social media where consumer preferences can change quickly, Instagram has proven to be resilient and adaptable. After the rapid rise of TikTok over the last couple of years, Instagram rolled out its own short form video product called Reels which has quickly gained adoption. According to the latest conference call “People re-share Reels 3.5 billion times every day.”

WhatsApp: Facebook acquired WhatsApp in 2014 for $19 billion. Today, it’s the most common messaging platform in the world with an estimated 2 billion active users. Like most of Meta’s FOA properties, WhatsApp possesses a clear network effect that helps drive low-cost adoption.

While the platform perhaps has the most reach of all Meta’s apps, it seems to be in the early stages of monetization. In the last few years, WhatsApp has rolled out several new solutions for business customers including embedded shopping, click-to-message ads, in-app payments, and the WhatsApp API for messaging 2-way communication with customers.

Despite iMessage’s dominance in the US, North America is actually the fastest growing geography for WhatsApp. During last quarter’s conference call, CEO Mark Zuckerberg stated “it is succeeding more broadly in the United States…And given the strategic importance of the U.S. and its outsized importance for revenue, this is just a huge opportunity.”

Facebook Marketplace: Facebook Marketplace is a bit of a hidden gem within Meta’s portfolio. Designed initially as a competitor to Craigslist, Marketplace has quickly become one of the most popular destinations on the internet to buy or sell new and used goods.

Like Amazon Promoted Listings, Facebook allows sellers to boost visibility of their products to other users through Facebook’s actual news feed. Used goods marketplaces often require local scale so given Facebook’s unmatched user base of more than 3 billion monthly active users globally, it’s not surprising to see that Marketplace has retained its dominant position within the Used Goods industry.