FactSet is a great end-to-end solution for investment professionals as it offers an integrated platform for researching, optimizing, and constructing portfolios.

However, spending $12,000 a year on a research terminal isn't ideal for all investors.

That's why we've spent hundreds of hours combing through potential alternatives. Here are the 5 best substitutes.

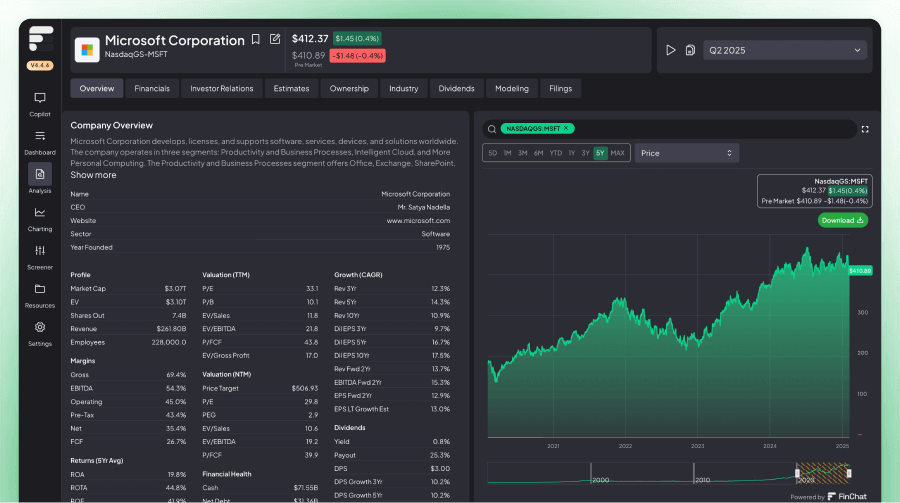

1.) FinChat.io

FinChat is the complete research platform for fundamental investors. With FinChat, investors get advanced financial data, company specific KPIs, robust analytics, and a conversational AI Assistant custom-built for investing questions.

Between its institutional quality data and intuitive design, FinChat is easy-to-use while having everything a fundamental investor needs.

FinChat.io enables users to quickly access the numbers that move the needle of the business and comprehensive fundamental analysis tools to make data driven investment decisions.

Additionally, FinChat.io offers a wide range of customization options, allowing users to tailor the platform to their specific needs and preferences. This is a modern take on the Bloomberg Terminal at a fraction of the price.

Here's a quick overview of FinChat's best features:

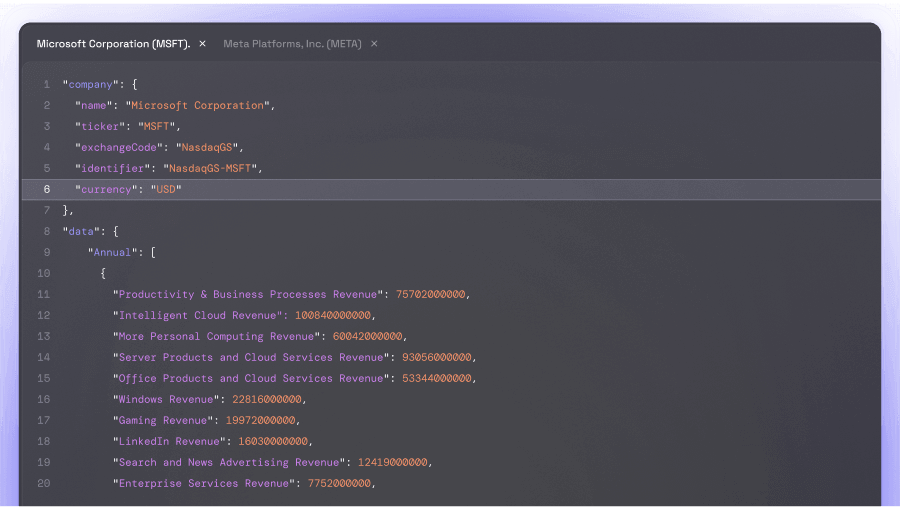

Institutional-Grade Data:

FinChat has comprehensive financial data on more than 100,000 stocks globally.

This includes all the standard data from financial statements, as well as a one-of-a-kind Segment & KPI database. FinChat's team of data analysts tracks the metrics that really matter, but don't always show up in the financial statements.

Want to see Amazon's Cloud Revenue? They track it.

Want to see Home Depot's store count? They've got it.

Want to know how many Lithography machines ASML sold last quarter? Yeah, they have that too.

FinChat's Segment & KPI database covers more than 1,500 stocks. And the list continues to grow every day.

Customizable Dashboards

Having a robust dashboard is critical for any investor. This allows investors to keep a better eye on their portfolios and track which stocks on their watchlist could be worth taking a deeper look at.

And FinChat's dashboard is best-in-class. It has:

Real-time prices stock prices.

500 different metrics to organize by.

Notifications for all positions.

Easy exports to Excel/Google Sheets.

Portfolio news feed.

Portfolio statistics & pie chart.

Conversational AI

Powered by its best-in-class financial database, FinChat.io offers the most robust conversational AI available to investors today.

By using the "Ask FinChat" feature, users can save time by getting a quick and easy-to-understand answer to any of their investing questions.

FinChat's AI also provides the direct sources to where it finds its answers.

Summary:

FinChat is the #1 solution because it wins in the following categories:

✅ Dashboards

✅ Depth of data

✅ User interface

✅ Charting

✅ Conversational AI

✅ Conference calls, transcripts, & events.

Pricing:

FinChat has 3 pricing tiers

Free: 5 years of financial data, 2 years of Segments & KPIs, 1 dashboard.

FinChat Plus: $24/month (billed annually) or $29/month (billed monthly). 10 years of financial data, 5 years of Segments & KPIs, unlimited dashboards.

FinChat Pro: $61/month (billed annually) or $79/month (billed monthly). 20 years of financial data, unlimited Segments & KPIs, unlimited AI prompts, Excel Add-in, & premium support.

To learn more, see the pricing page.

2.) Koyfin

Koyfin is a financial analytics platform that offers a wide range of tools for investors to gain insights into their investments. The platform provides advanced graphing, market dashboards, and various features for portfolio management and stock research.

Summary:

Here's where Koyfin scores well:

✅ Very customizable

✅ Advanced charting capabilities

✅ Covers stocks globally

Pricing:

Koyfin offers three pricing plans:

Free: 2 watchlists, 2 screens, 2 chart templates, advanced graphing, and market dashboards.

Plus: $39 per month. Offers 10 years of financials, unlimited watchlists, 10 metrics per watchlist, global market news, and full access to snapshots.

Pro: $79 per month. Includes everything in the Plus plan, as well as unlimited custom formulas, US mutual fund data, mutual fund holdings, custom FA templates, and exclusive training webinars.

3) YCharts

YCharts is a powerful and versatile financial data platform that offers a wide range of tools for stock and fund research, economic data analysis, and market insights. It caters to individual investors, professional advisors, and large firms.

Summary:

Here's where YCharts scores well:

✅ Intuitive Charting

✅ Macroeconomic Data

✅ Customizable Dashboards

Pricing:

YCharts offers four pricing plans:

Analyst: Designed for individual investors with access to select tools and data.

Presenter: Designed for educators and consultants as it helps in generating proposals and meeting prep.

Professional: Targeted at financial advisors, portfolio managers, CFAs, and CFPs, offering all tools and data.

Enterprise: Best suited for advisor teams, home offices, asset management firms, and OCIOs, providing all tools and data with additional customization, firm-wide sharing, and compliance controls.

Specific prices are not provided.

4) S&P Capital IQ

If cost isn't a primary consideration for you, these next two solutions are also great alternatives to FactSet.

S&P Capital IQ Pro is a powerful platform that provides unrivaled breadth and depth of data across various industries and asset classes. The platform combines essential intelligence on millions of data points, including public company financials, estimates, ownership, transactions, and deep industry data.

Summary:

Here's where Cap IQ scores well:

✅ Breadth and Depth of data

✅ Sophisticated Search Capabilities

✅ Credit Ratings

Pricing:

Cap IQ's pricing is not publicly disclosed on the website. 3rd party reports estimate the cost at more than $20,000 a year.

5) LSEG Eikon

LSEG Eikon (Formerly named Refinitiv Eikon) is an open-technology solution for financial market professionals. Powered by a truly comprehensive dataset, LSEG Eikon also enables analyst teams to easily message and collaborate.

Summary:

Here's where LSEG Eikon scores well:

✅ Comprehensive Data

✅ Messaging & Collaboration

✅ Exclusive News (Reuters)

Pricing:

Refinitiv's pricing is not disclosed on its website, but 3rd party reports estimate the cost at $22,000 per year. Customers can also get a more bare-bones version for as little as $3,500 per year.