Poland is one of the cheapest stock markets in the world among developed economies.

Based on the latest data, Poland's Total Market Cap as a percentage of GDP stands at just 21.5%, putting it 48th out of 74 countries with available data. For context, countries like the United States, Canada, and the United Kingdom all have a Market Cap to GDP percentage above 100%.

With that in mind, Poland may very well be a good place to fish for potentially undervalued companies.

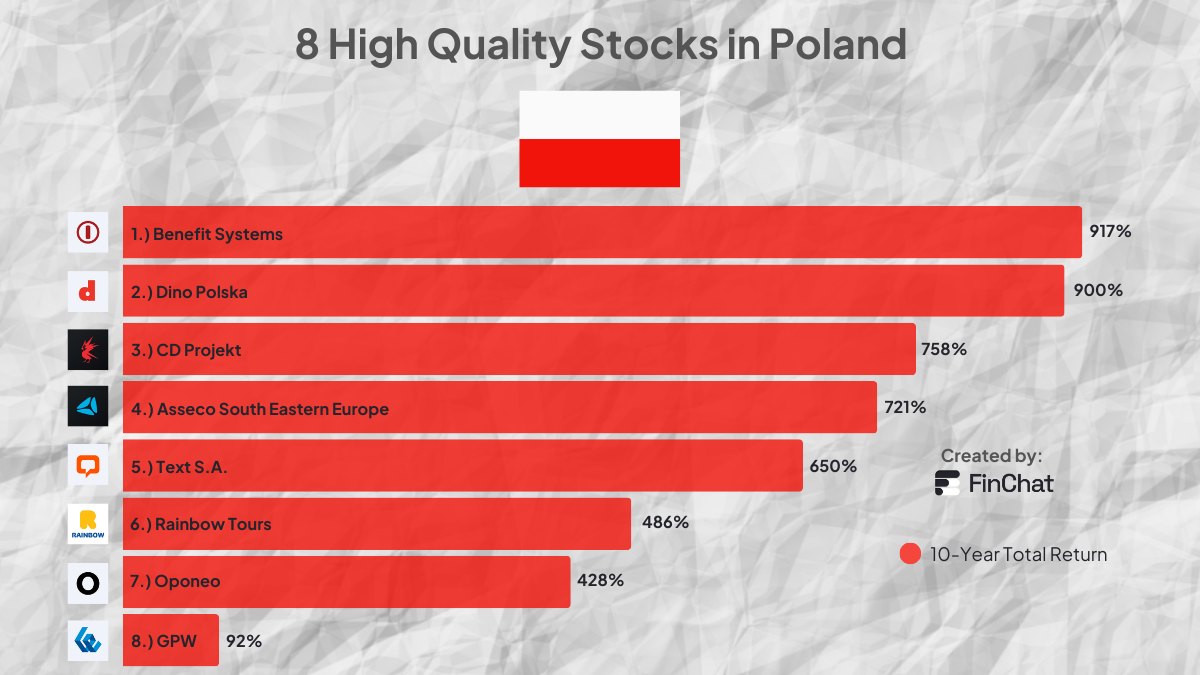

Here are 8 High Quality Companies from Poland with an Enterprise Value to EBIT ratio below 25x.

1.) Benefit Systems S.A.

Benefit Systems provides fitness and active lifestyle programs to companies on behalf of their employees.

While they offer solutions that span a variety of well-being needs, its flagship product is the MultiSport program which gives access to ~4,900 fitness facilities.

10-yr Total Return: 917%

Market Cap: $1.8 billion

10-yr EPS CAGR: 27.8%

EV/EBIT: 16x

2.) Dino Polska

Dino Polska operates a chain of supermarket stores across Poland. Within its mid-sized grocery stores, Dino sells everything from high quality meats to fresh produce.

Over the last 10 years, the grocer has increased its store count more than 10-fold while consistently delivering strong same-store sales growth.

Throughout this period of rapid growth, Dino Polska has maintained returns on invested capital above 15%.

10-yr Total Return: 900%

Market Cap: $10.5 billion

10-yr EPS CAGR: 41.6%

EV/EBIT: 19.5x

3.) CD Projekt S.A.

CD Projekt is video game developer, publisher, and distributor that operates through 3 different studios.

Their 2 largest videogame franchises are The Witcher and Cyberpunk.

Though their business is hit-driven and often quite cyclical, CD Projekt has remained free cash flow positive in each of the last 9 years.

10-yr Total Return: 758%

Market Cap: $2.98 billion

10-yr EPS CAGR: 34.3%

EV/EBIT: 24x

4.) Asseco South Eastern Europe S.A.

Asseco South Eastern Europe (ASEE) is one of the largest IT providers of banking & payments solutions in its region.

In addition to developing and selling their own software, ASEE also helps its customers select and integrate software from other 3rd party vendors.

10-yr Total Return: 721%

Market Cap: $642 million

10-yr EPS CAGR: 18.8%

EV/EBIT: 10x

5.) Text S.A.

Text S.A. sells ChatBot software to roughly 38,000 businesses globally. Its most popular solution (LiveChat) lets business owners easily chat and interact with visitors on their website. This solution helps boost productivity and response times for customer service teams.

Despite operating in Poland, two thirds of Text S.A.'s revenue comes from English speaking markets, predominantly the United States.

Over the last few years, this industry has become more competitive particularly with the rise of conversational AI. Investor concerns have left the stock down 39% from its highs and trading at just 12x its last 12 month EBIT.

10-yr Total Return: 650%

Market Cap: $586 million

10-yr EPS CAGR: 40.7%

EV/EBIT: 12x

6.) Rainbow Tours S.A.

Rainbow Tours is tour operator in Poland, the Czech Republic, Slovakia, Lithuania, Belarus, and Ukraine.

Through its various branches, the company helps customers plan tours of all types from last second trips to long distance airplane trips.

In addition to operating tours, the company also earns revenue from commissions as a travel agent.

10-yr Total Return: 486%

Market Cap: $287 million

10-yr EPS CAGR: 28.1%

EV/EBIT: 4x

7.) Oponeo S.A.

Oponeo is a leader in the online sales of tires and rims for cars, trucks, and motorcycles.

From its 56,000 square meter logistics center, Oponeo sells as much as tires a day to individual customers.

Though Oponeo is based out of Poland, the company has customers all around the globe.

10-yr Total Return: 428%

Market Cap: $185 million

10-yr EPS CAGR: 35%

EV/EBT: 19x

8.) Gielda Papierów Wartosciowych w Warszawie S.A.

GPW operates Poland's leading financial exchanges (equities, bonds, commodities, etc.), most notably the Warsaw stock exchange.

The Warsaw stock exchange's roots date back to 1817 and today the company helps move money and securities from customer to customer through its clearing and exchange services.

Its customers include individual investors, brokers, and companies.

Though its profitability tends to ebb and flow with overall market sentiment, GPW has been positive for more than 20 years in a row.

10-yr Total Return: 92%

Market Cap: $476 million

10-yr EPS CAGR: 3.5%

EV/EBIT: 9x

If you'd like to search for other high quality Polish stocks, the FinChat Screener is one of the easiest ways to do so.

Simply select Poland in the country tab, input your preferred criteria, and start screening!